Email Address

machineshopinsurance@gmail.com

Phone Number

866-226-4436

Our Location

315-A S. Diamond Bar Blvd Diamond Bar, CA 91765

machineshopinsurance@gmail.com

866-226-4436

315-A S. Diamond Bar Blvd Diamond Bar, CA 91765

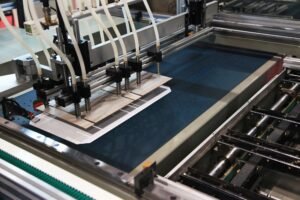

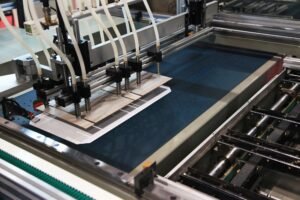

Running a Tool and Die Shop comes with unique risks, from machinery breakdowns to employee injuries. Protecting your business with the right insurance coverage is essential for long-term success and peace of mind. At [Your Agency Name], we specialize in providing insurance for tool and die shops that include comprehensive coverage tailored to your specific needs.

Our insurance offerings include General Liability Insurance, Workers’ Compensation Insurance, and a Business Ownership Policy (BOP), all designed to safeguard your shop, employees, and assets from potential risks.

General Liability Insurance is essential for tool and die shops, as it protects your business from third-party claims involving bodily injury or property damage. In a high-risk environment like a tool and die shop, accidents can happen at any time. Whether it’s a customer injured on-site or property damaged by a piece of equipment, this insurance ensures that your shop is covered financially.

Bodily Injury Coverage: Covers medical expenses and legal fees if someone is injured on your premises.

Property Damage Coverage: Protects against any damage caused to a third party’s property.

Legal Defense Costs: Provides financial assistance for legal fees in the event of a lawsuit.

Workers’ Compensation Insurance is a crucial part of your shop’s risk management strategy. This insurance provides coverage for employees who suffer work-related injuries or illnesses. Since tool and die shops involve the use of heavy machinery, workers are at risk of serious injuries. Workers’ Compensation Insurance helps cover medical bills, rehabilitation costs, and lost wages during recovery.

Medical Treatment: Pays for medical expenses for injuries that occur while on the job.

Wage Replacement: Offers wage replacement for workers unable to return to work due to injury or illness.

A Business Ownership Policy (BOP) combines several essential coverages into a single policy. For tool and die shops, a BOP typically includes General Liability Insurance, Property Insurance, and Business Interruption Insurance. This package offers complete protection for your physical assets, employees, and your shop’s day-to-day operations.

Property Insurance: Covers damages to tools, equipment, and physical structures in your shop.

Business Interruption Insurance: Replaces lost income if your shop is temporarily unable to operate due to unforeseen circumstances like fire or natural disaster.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Specialized in business insurance for machine shops

Coverage options from trusted providers like Chubb Insurance machine shop policies

Affordable plans to fit any CNC machine shop insurance cost

Protection for single-owner shops to large multi-location facilities

Experience insuring precision shops like Eddie’s Precision Machine Shop

Get the Latest News and Offers Stay connected with us for all the latest updates, products, and services to help you protect your business.

General Liability Insurance protects your shop from third-party claims involving injuries or property damage that occur on your premises.

A BOP combines General Liability Insurance, Property Insurance, and Business Interruption Insurance into one affordable policy, providing all-around protection for your shop.

Workers’ Compensation Insurance covers medical costs, rehabilitation, and lost wages for employees who are injured on the job. It ensures compliance with state regulations and protects your business from lawsuits.

Workers’ Compensation Insurance covers medical expenses, rehabilitation, and lost wages for employees who are injured while working, offering essential protection for both your team and your business.

In most states, Workers’ Compensation Insurance is mandatory for any business with employees, particularly those in high-risk industries like tool and die manufacturing.

Yes, we offer home machine shop insurance that covers smaller operations run from home, including machinery, tools, and general liability.